b&o tax states

So if youre in the service and sales category you owe 15 for every 1000 of income. So if youre in the service and sales category you owe 15 for every 1000 of income.

Business And Occupation B O Tax Washington State And City Of Bellingham

Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level.

. It applies to the gross income of the business. 32 rows B. It applies to the gross income of the business.

Second the BO has a very low rate and a broad base. Constitution because it discriminates against out-of-state financial institutions. The map below depicts the TRA boundaries and.

Most Washington businesses fall under the 15 gross receipts tax rate. The nexus determination for sales tax is similar to the BO. 3 The revisions incorporated within Emergency Rule 19404 may significantly impact the BO tax liability of financial institution taxpayers beginning January 1 2016.

International Charter Freight Brokers. The appropriate BO tax classification depends on the nature of the business activity. The BO tax is a gross receipts tax assessed against an entity for conducting business in Washington.

Not even US Treasuries offer income that is free from federal income taxes. The use tax generally applies to the storage use or other consumption in California of goods purchased from. Washington has a state sales tax rate of 65 which is collected on all retail sales across the state.

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO tax. The BO tax is a gross receipts tax assessed against an entity for conducting business in Washington.

No deduction is allowed for labor materials taxes or other costs of doing business. There is no taxable wage limit. Each TRA is assigned a six-digit numeric identifier referred to as a TRA number.

Contact the Taxpayer Assistance Center at 1-888-745-3886 or visit your local Employment Tax Office. By David Volkert State and Local Tax Supervisor Not sure what a local BO tax is. Washington unlike many other states does not have an income tax.

Unlike the retail sales tax a sale does not have to occur for a. Business registration is done through the State of Washington Business Licensing Service. A 484 percent or 004 increase.

But service businesses pay a 15 rate. Dann Mead Smith president of the Washington Policy Center says the BO is hard to kill for several reasons. The relationship between the state BO tax and the local BO taxes is similar at least in concept to the sales tax.

However your business may qualify for certain exemptions deductions or credits. Extracting Timber Extracting for Hire Timber003424. Slaughtering Breaking and Processing Perishable Meat.

A one-time 4000 city. There is no penalty on late returns with no tax due. While deductions are not permitted for labor materials or other overhead expenses the State of Washi.

First the most likely alternative is an income tax which would ahave a negative impact on the states attractiveness as a place to do business Smith says. Additionally municipal bonds can be free of. This means no deduction is allowed for labor materials taxes or other costs of doing business.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. However your business may qualify for certain exemptions deductions or credits. Washington State BO tax is based on the gross income from business activities.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Washingtons BO tax is calculated on the gross income from activities.

It applies to the gross income of the business. The state BO tax is a gross receipts tax. If you buy 10000 worth of municipal bonds with a 4 coupon the 400 you receive every year is tax-free.

Soybean Canola Processing00138. The BO tax for labor materials taxes or other costs of doing business. It is a type of gross receipts tax because it is levied on gross income rather than net income.

This is the most significant benefit of municipal bonds and it is a characteristic unique to municipal bonds. Extracting Extracting for Hire00484. The first 1000000 in taxable gross receipts are taxed at 150 minimum tax due and any gross receipts above that are taxed at 026.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Businesses with 150000 or more in revenues attributable to Ohio are responsible for paying Ohio Gross Receipts Tax Commercial Activity Tax either annually or quarterly. Review the PIT withholding schedule.

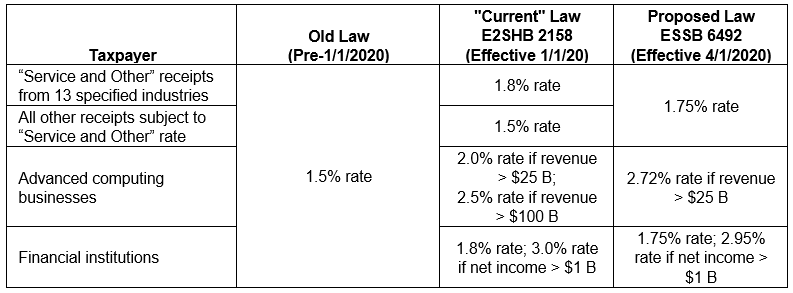

Heres what the BO tax looks like for your business. Manufacturing Wheat into Flour. B O tax rates When paying the B O tax to the Department of Revenue you declare your income in different categories.

However you may be entitled to the Multiple Activities Tax Credit MATC. The following chart gives the rates for each main category. It is measured on the value of products gross proceeds of sale or gross income of the business.

Marketplace facilitators such as Amazon typically collect sales tax at the retail sales rate which ranges from 7 to 105 depending on location and industry. May 13 2020 A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US. The appropriate BO tax classification depends on the business activity.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. There is no maximum tax. The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US.

While the claim that we dont have an income tax is technically true you pay the BO tax on your gross income. Accordingly taxpayers classified as financial institutions for BO tax purposes must adhere to Emergency Rule 19404 for tax periods beginning on or after January 1 2016. The withholding rate is based on the employees Form W-4 or DE 4.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. Washingtons unique gross receipts excise tax better known as the business and occupation BO tax has caused many headaches for businesses residing in the Evergreen State. Over the last several years Washington has enacted several changes to its BO tax that will extend similar challenges to non-Washington based businesses.

States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky. Public Service or Utility Business Forms.

B Amp O Tax Return City Of Bellevue

Twitter Aviation Industry Boeing Jet Engine

Photo N747bc Cn 25879 Boeing Company Boeing 747 4j6 Lcf By Brock L In 2021 Boeing Dreamlifter Boeing 747 Airplane Photography

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Model Trains

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

World S Largest Airplane Photographic Print Allposters Com In 2021 Boeing 747 Boeing World

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Aviation Industry Boeing Everett Factory Boeing

Why Our B O Tax Is Unfair R Seattlewa

First Produciton 747 100 Nose Section Is Mated With Wing Section Boeing Aircraft Aviation Mechanic Aircraft

Changes To Washington S B O Tax Economic Nexus Standard And Use Tax Notice And Reporting The Cpa Journal

B Amp O Tax Guide City Of Bellevue

What Is The Financial Statement Presentation For Washington B O Tax Expense I Believe It Should Be Opex But My Cfo And Controller Think It Should Be Below The Line Quora

%20Taxes/bo-tax-header.jpg)